Making sense of Zerodha’s strategy

Zerodha is a discount broker and has disrupted the space with its pricing strategy. It allows users to buy, sell and trade stocks, futures & options, currencies, and commodities at discounted rates. For example, an institutional broker (like Motilal Oswal) used to charge a % fee (let’s say 0.25%) per trade whereas Zerodha charged a flat fee (INR 20) for every trade executed.

Nithin Kamath (Founder, Zerodha) recently made a statement that raised some eyebrows.

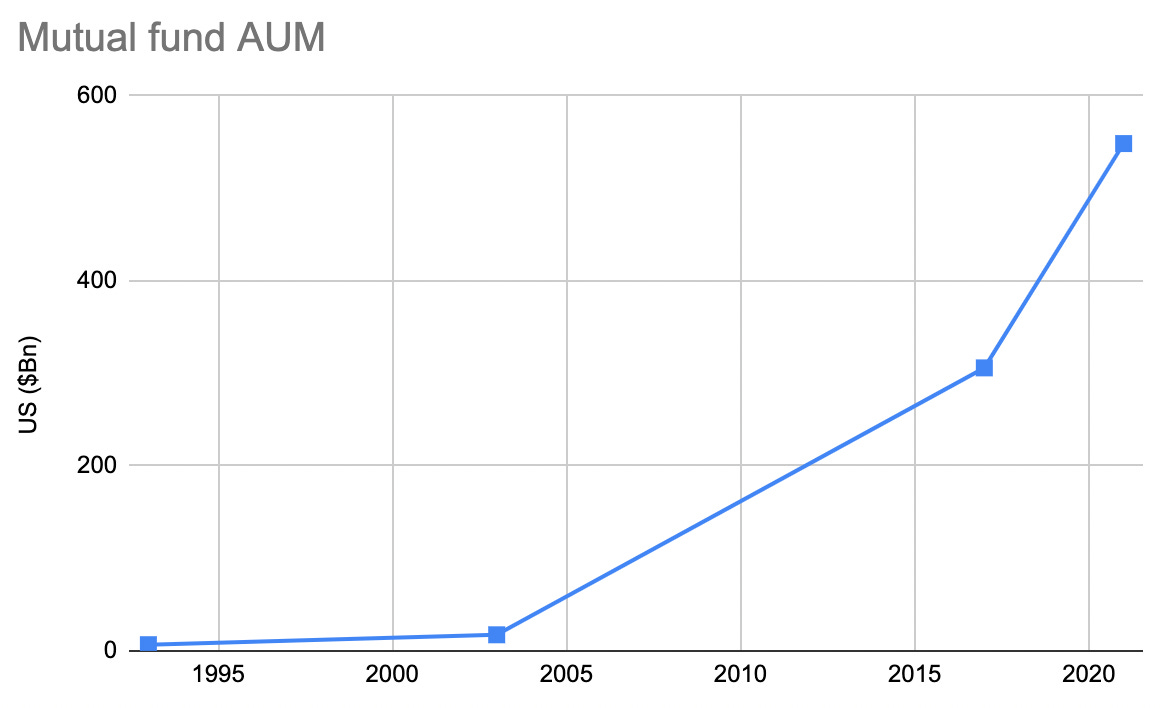

Let’s track back to February 2020. There are ~18.5MN mutual fund investors in India and Nithin saw that as the next big growth vector for Zerodha.

In September 2021, Zerodha received its AMC license.

And this is why I think it’s a brilliant move.

To start with, I’d like to point out why I like AMC businesses and why Fintechs might be interested.

Why start an AMC

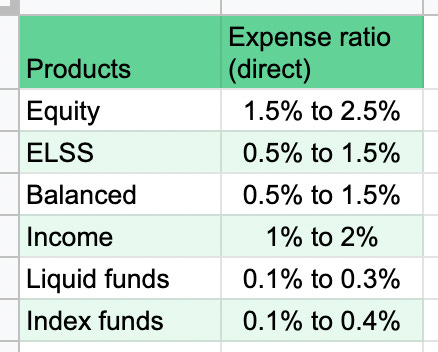

It’s easy to understand — a simple fee (expense ratio charged as % of AUM) based business model where the AMC sells intellectual capital; this makes the economics of the business highly favorable.

It’s not capital intensive.

It has massive operating leverage; profit margins improve significantly as you scale.

Barriers to entry are high due to licensing; AMCs need a license from SEBI.

As investor AUM compounds, earnings compound.

It’s a sticky business with more investors realizing the power of compounding.

People brag about their returns and in turn bring more people into the system.

While the industry is competitive, market share is fairly distributed amongst AMCs. Structurally, this isn’t a winners take all market. There are many reasons for it: Indian investors on average hold more than 9 funds in their portfolio (not a good stat but reality), product-mix varies between AMCs, distribution is tough, and geography-specific (70%+ AUM is concentrated in top 5 cities).

It has strong growth triggers

Household income is growing and so is savings (in absolute terms).

Household savings growing as % income (this includes gold, real estate, etc).

Financial savings growing as % of household savings.

Mutual fund investments as % of financial savings growing. One reason for this being the declining bank deposit rates to make up for NPAs and investors realizing they need to invest to earn higher yields.

Now that we’ve established that the economics and the growth scenario are favorable, let us assess why Zerodha and other Fintechs might start their own AMCs.

Distribution is a strong moat

Since most traditional MF houses did not want to invest in a large in-house sales team, they remained dependent on their distributors to reach out to investors. A distributor is a broker who sells an MF scheme to the investor and gets commissions from the fund house in return.

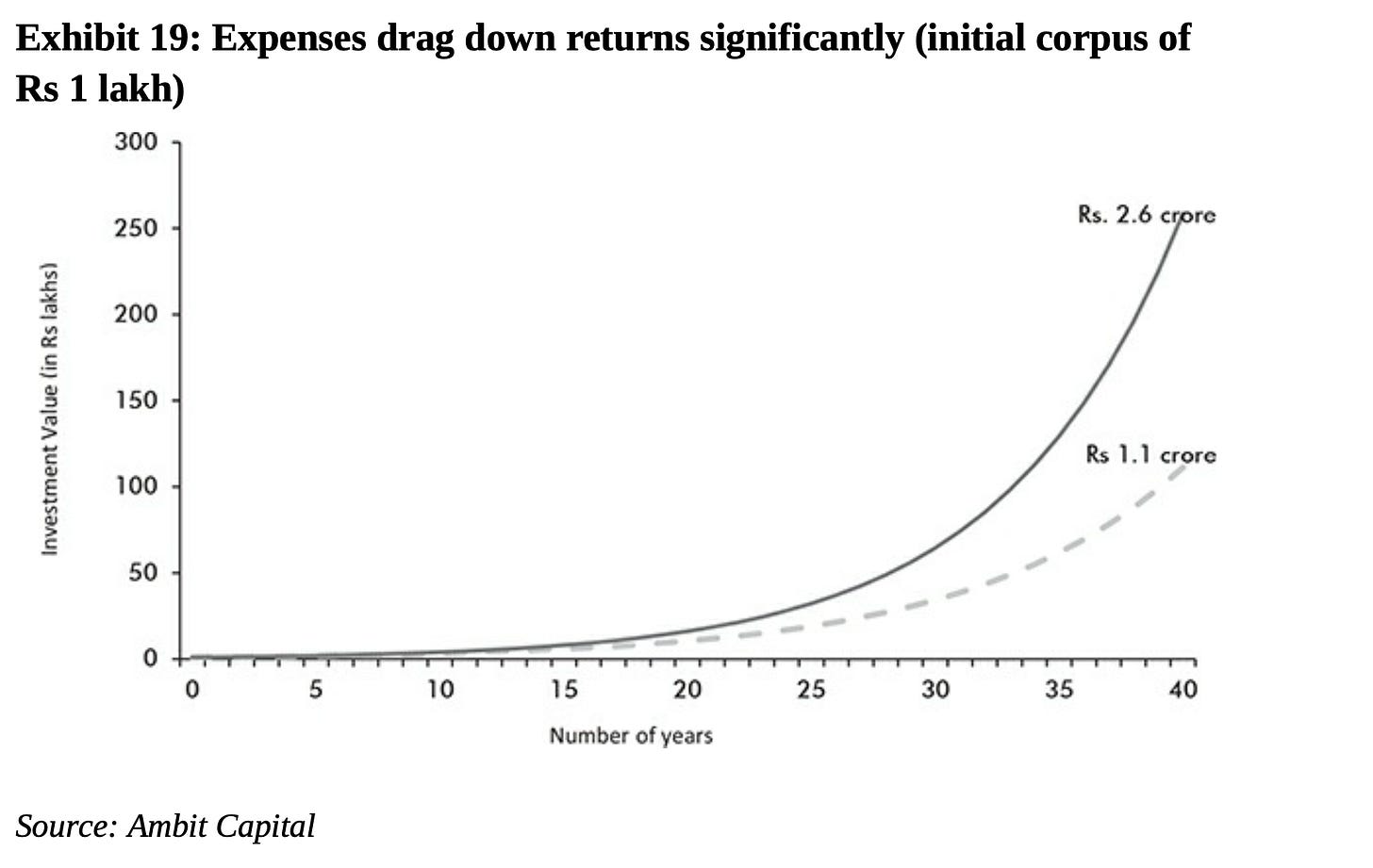

Distributor commissions defeat the basic purpose of investing money. And remember, expenses compound too.

Modern-day Fintechs on the other hand are building a strong content engine to educate users (only 5% of household assets are invested into financial assets), and growing internet penetration is helping them transcend the geographical boundaries (70% of the MF AUM is concentrated in the top 5 cities). Youtube, Twitter, Instagram, Telegram, Fintechs are leveraging all these channels to create distribution at scale. They’re addressing the problems of financial awareness and low investor education to create a “pull” towards these products (vs the traditional “push” distribution model). This thread perfectly encapsulates the point I’m trying to make.

Room to try disrupt certain product categories

MFs are sold through 2 routes: regular (distributor-led) and direct (no intermediaries, dealing directly with the fund house).

Direct plans are much cheaper (by 0.5% to 1% per annum in equity and 0.05% to 0.5% per annum in debt). These fees were almost half the expenses charged by conventional mutual funds, which remain in the vicinity of 2% to 2.5% in equity and 0.5% to 2.25% in debt. The difference in fees is obviously due to the distributor or broker being disintermediated by direct schemes.

For an AMC, all AUM is not equal. Equity pays the highest expense ratio (and thus generates the highest profit after tax) and offers significant room for pricing disruption. Debt mutual funds on the other hand are the elephant in the room and need to be looked at more closely.

Tech and digital brand advantage

While traditional fund houses rely on fund managers and their decision-making to outperform the markets, Fintechs have an inherent tech advantage that will enable them to try out new investing strategies in a faster and more efficient manner.

Having a brand is required in this space, it does not guarantee success. Investors are more interested in looking at the expense ratios and the historical performance. Nevertheless, a strong brand image always helps.

In conclusion

The old model of manufacturing and distributing MFs is broken at every level in India. Experienced fund managers don’t put you in a position of advantage — data from the past decade tells us that a lot of fund managers have struggled to outperform the index and generate alpha for their investors. Having a big brand (like HDFC, ICICI, etc) isn’t all that advantageous but cannot be discounted either.

All said and done, running an AMC isn’t easy and a lot of players (both domestic and foreign) have tried and burned their hands trying to scale. The bottoms-up trends are hinting at an interesting opportunity that lies ahead. In my opinion, Fintechs that get the product mix right (either go niche or create a supermarket with an assortment of products) and ace distribution are likely to win.

What's your @, would like to chat.